Proyecto 2

A semi-parametric specification of the incomplete EASI demand system: Welfare implications of a tax

Resumen: We provide a novel inferential framework to estimate the exact affine Stone index (EASI) model. Our inferential framework is based on a non-parametric specification of the stochastic errors using Dirichlet processes mixtures that allows handling non-normal errors, gaining efficiency, identifying clusters, and taking into account, microeconomic restrictions, censoring, simultaneous endogeneity, and non-linearity. We perform a welfare analysis due to a tax on electricity consumption using a novel data set in thee Colombian economy. We find that 95% of the households belong to one cluster and that there is a 95% probability that the equivalent variation of the representative household is between USD cents 34.1 and USD cents 34.3, given an approximately 1% tariff increase (USD cents 0.12), that is, the welfare loss is approximately 300 times the actual tariff increase.

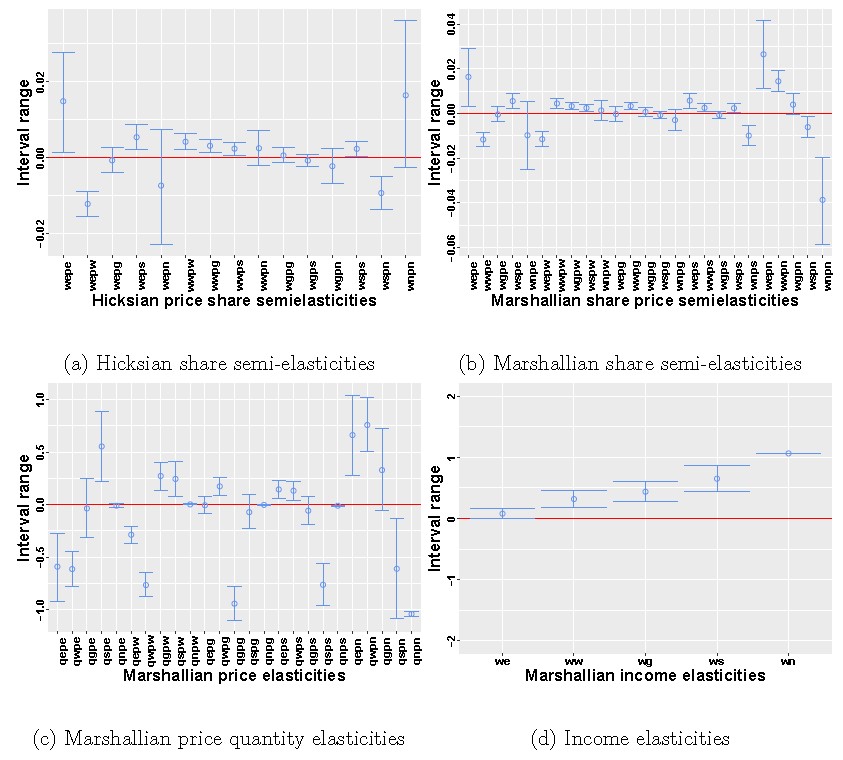

Figure. Price and income elasticities: Utilities in Colombia.

Panel A: Hicksian price share semi-elasticities. Panel B: Marshallian price share semi-elasticities.

Panel C: Marshallian price quantity elasticities. Panel D: Income elasticities.

Notes: Circles are posterior mean values, and bars are 95% credible intervals. Notation wupj (qupj) indicates the effect of percentage change in price of good j on share (quantity) for good u.